Put option formula

P Price of the Put Option. The delta of an option measures the amplitude of the change of its price in function of the change of the price of its underlying.

Among The Best Chart Patterns I Ve Discovered For Straddle Option Trade Opportunities Are What Are Commonly Known Option Trading Option Strategies Strategies

Your profit would be 10 but if you were to buy more options you would multiply your gains or.

. If you want to calculate the value of the put option then we will need 2 parameters. They are due to expire in 2 days. Formula delta Nd1 - 1 small.

If BP share price is expected to be 58 and 61 tomorrow and day after tomorrow respectively when it would be profitable to exercise the. S underlying price per. At Stock Options Channel our YieldBoost formula has looked up and down the RBLX options chain for the new October 28th contracts and identified one put and one call.

S Spot Price. The strike is 47 in this case and Bank of America. Put Option Formula.

I Pe N-d2 e-rt Pa N-d1 black scholes or. Put Option Calculator is used to calculating the total profit or loss for your put options. According to the Black-Scholes option pricing model its Mertons extension that accounts for dividends there are six parameters which affect option prices.

You could purchase one put option and sell it for 1290 at the end of the day. For example the 11 put may have cost 065 x 100 shares or 65 plus commissions. Ii c Pa Pe e-rt put call parity May 2 2014 at 908 am167093.

Phileft d1 right frac e -frac d1 2 2 sqrt 2pi. Calculating the profit or loss that will be incurred when a put option is exercised is gotten by finding the difference between the strike price of the underlying. Put options profit or loss formula.

The long put calculator will show you whether or not your options are at the money in the money or out. Theta -frac Sphileft d1 right sigma 2sqrt trKe -rtNleft -d2 right small where. Two months later the option is about to expire and the stock is trading at 8.

PV x Present Value of the Strike Price being x This equation suggests there shall be an equilibrium between the call option and the put option. The exercise price The current market price of the underlying asset. A put options intrinsic value is the amount by which the puts strike price is higher than the current market price of the underlying stock.

Find Your Perfect Anti Aging Routine Anti Aging Skin Products Anti Aging Skin Treatment Aging Skin Care

Pin By Arturo Rodriguez On Finance Option Pricing Pricing Formula Stock Options

A Financial Option Is A Financial Derivative That Involves A Contract To Buy Or Sell An Underlying Asset Stock Options Trading Option Trading Option Strategies

Put Call Parity Refers To The Static Price Relationship Between The Prices Of Put And Call Options Of An Asset With Th Exam Fisher College Of Business Formula

Money Management To Trade Forex Get The Free Download Ebook Click The Link Or Visit Website Www Pipsumo Com Money Management How To Raise Money Money Skills

Icse Soiutions For Class 10 Mathematics Factorization Maths Formula Book Mathematics Math Methods

Tom S Tutorials For Excel Converting All Formula Cell References From Relative To Absolute Excel Tutorials Excel Tutorial

Options Trading Terminology Are Explained In Hindi We Will Also See Option Chain With Call And Put Option On Nse Website To Option Trading Put Option Trading

Class 9 Maths Solution Maths Solutions Linear Equations Math

Pin By Anand Masurkar On Stock Market Quotes Stock Market Quotes Marketing Meme Stock Market

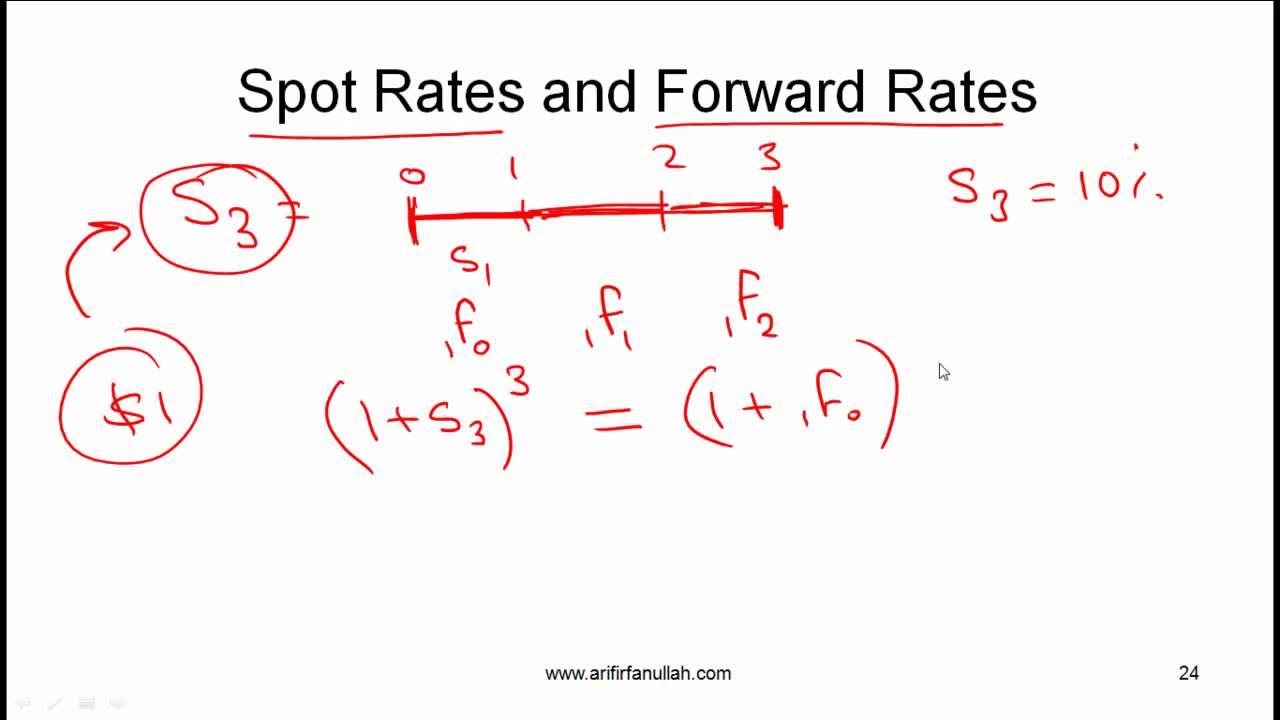

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video

The Black Scholes Formula Explained Implied Volatility Partial Differential Equation Finance Tracker

First Week Of Ea May 20th Options Trading Option Trading Options One Week

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula

Options Are Financial Derivatives Mainly Of Two Types Call Option And Put Option We Must Understand These Concepts Fo Put Option Call Option Option Trading

Rd Sharma Class 11 Solutions Chapter 23 Straight Lines Ex 23 15 Math Vocabulary Solutions Class

Selina Concise Mathematics Class 9 Icse Solutions Compound Interest Without Using Formula A Plus Topper Hydrogen C Mathematics Compound Interest Solutions